In 2024, the general trend of China's domestic PP market price showed a trend of rising first and then falling. As of October 23, the average price was basically the same as in 2023. Under the background of loose supply and demand, the center of gravity of PP prices continued to run at a low level during the year, and the amplitude continued to narrow year-on-year, and many months broke the seasonal law. In the next two months, PP will continue to be carried out under the game of weakening fundamentals and positive macroeconomic expectations. It is expected that prices will continue to fluctuate at a low level. At the same time, under the characteristics of narrow profits in various links of the industrial chain, the price amplitude may remain in a low value range.

Price operation: Prices rose first and then fell during the year.

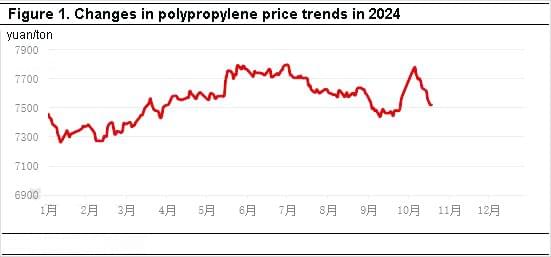

The overall trend was low at both ends and high in the middle. From January to October 2024, the general trend of the domestic polypropylene market rose first and then fell. Although there was a significant rise from the end of September to early October, it fell again after mid-October. Taking the PP drawing price in the East China market as an example, the highest price appeared at 7795 yuan/ton in early July, and the lowest price appeared at 7265 yuan/ton in mid-to-early January. In terms of average price, as of October 23, 2024, the average price of wire drawing in East China was 7552.10 yuan/ton, which was slightly higher by 0.35% than 7525.47 yuan/ton in the same period of 2023, which is basically flat.

In terms of specific changes, the PP market price showed a narrow range of fluctuations from January to early March. During this period, the disturbance of events in the Red Sea region, the demand game before and after the Spring Festival, the macro policy expectations, and the fluctuations in crude oil prices affected the market price performance in different time periods. Since mid-to-early March, the market has been rising all the way under the support of many favorable factors such as cost strengthening, supply growth lower than expected, and macro policy stimulus. In June, although the macro-favorable sentiment was gradually digested, the weak supply and demand in the month and the high cost support kept the price fluctuating at a high level. It was not until July that the market trend began to turn downward as the supply and demand pressure gradually increased and the cost fell. Although September entered the traditional peak season for demand, the actual demand was lower than expected, and the worrying macro atmosphere caused the market price to continue to decline. At the end of September, with the release of favorable news such as the Fed's interest rate cut and the domestic reserve requirement cut and interest rate cut, the mood of participants warmed up. In addition, crude oil rose continuously during the National Day holiday, and the market quickly rose after the holiday, but the poor actual demand dragged down the market, and crude oil gave up the previous gains. The market price fell again, and the downward rhythm was fast. Overall, the PP price from January to October 2024 showed a trend of low at both ends and high in the middle. As of October 23, the price was slightly higher than the price level at the beginning of the year.

Price operation characteristics 1: Under the background of loose supply and demand, the price continues to be at a low level.

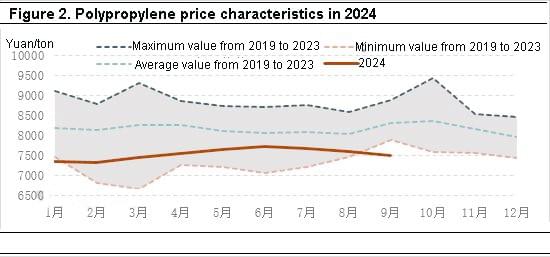

Judging from the price fluctuation characteristics of polypropylene in the past five years, the PP price in 2024 is at a medium-to-low level in the same period of previous years, with January and September both hitting historical lows in the same period of previous years. In 2024, the domestic economy continued to recover, but the overall demand still showed a state of "weak demand". Under the condition of insufficient effective demand, the downstream industry is highly competitive, the price of finished products continues to decline, profitability weakens, and the factory's market perception deteriorates. Transmission to the raw material market is manifested in the low enthusiasm of downstream factories for raw material procurement, and the normalization of low inventory rigid demand stocking, which in turn suppresses the price of the raw material market. In terms of supply, PP will continue to expand in 2024, with 2.45 million tons of new capacity added from January to September, and domestic PP production will increase by 7.91% year-on-year. Therefore, the overall supply and demand of PP in 2024 will be loose, especially the demand will be under pressure, resulting in the price center of polypropylene continuing to run low.

Price operation characteristics 2: Intensified supply and demand game Price fluctuation amplitude continues to narrow

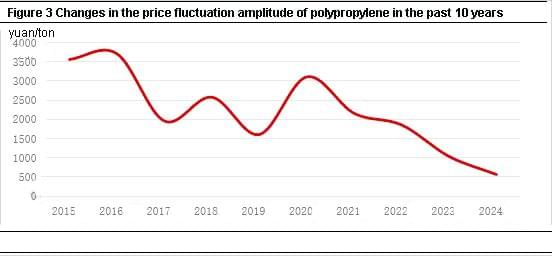

From the perspective of PP price fluctuations in the past 10 years, the amplitude has shown a trend of shock narrowing, especially since 2020, the amplitude has narrowed faster, and the amplitude narrowing in 2024 is more obvious. On the one hand, under the background of gradual oversupply, market adjustments have accelerated. Although the continuous growth of new production capacity has put pressure on the market, upstream companies have actively adjusted their load balance to balance weak demand, which has slowed down the decline in prices to a certain extent. The policy efforts have also improved demand expectations in stages and supported prices. On the other hand, the profitability of the upstream, midstream and downstream industrial chains of PP has declined in recent years, resulting in cautious operating mentality of participants and a decline in market trading vitality. According to Zhuochuang Information data statistics, from January to September 2024, the high and low price amplitude of PP was 560 yuan/ton, narrowing by 470 yuan/ton compared with 2023 and 2540 yuan/ton compared with 2020.

Price operation characteristics 3: Prices break the seasonal law.

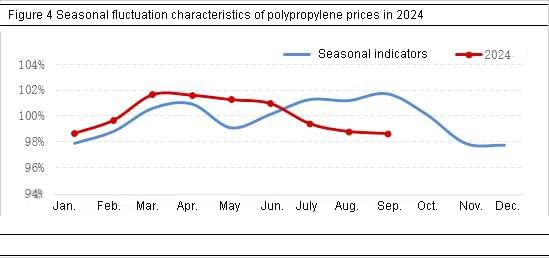

Some months show counter-seasonal rise or fall. According to the historical 10-year polypropylene price operation characteristics, prices usually rise month-on-month in March and April and the third quarter, and prices fall month-on-month or run at a low level in May, June and the fourth quarter. Generally, the high point of the year occurs in September, and the low point occurs in the middle of the year.

However, from the perspective of the polypropylene price operation trend in 2024, PP prices show counter-seasonal rises in May and June, and counter-seasonal declines in the third quarter. PP prices break the seasonal fluctuation law, which is ultimately a phased mismatch between supply and demand. The counter-seasonal rise in prices in May and June is due to the fact that PP maintenance equipment is concentrated in May and June compared with previous years, and the loss volume is much higher than the same period of previous years. Therefore, the supply is not abundant; on the other hand, the concentrated release of macroeconomic policies in May reversed the market pessimism and expectations of weak demand. The mentality of participants was boosted, which led to a continuous increase in PP prices. Although the actual demand in June was insufficient to slow down the upward pace of prices, it still maintained an upward trend month-on-month. The counter-seasonal decline in prices in the third quarter was due to insufficient policy support in the third quarter, which led to market expectations being dashed. Although market prices recovered somewhat at the end of September due to the release of favorable news such as the Fed's interest rate cut and the domestic reserve requirement ratio and interest rate cut, the sustainability was poor. On the other hand, seasonal demand was not reflected from late August to September, and insufficient actual demand dragged down market prices. Overall, prices broke the seasonal pattern in many months during the year, showing the characteristics of "not slack in the off-season" and "not busy in the peak season".

(Note: above the 100% line indicates that the price rose in the current month, and the higher it is, the greater the month-on-month increase in the price; below the 100% line indicates that the price fell in the current month, and the lower it is, the greater the month-on-month decrease in the price)

The fourth quarter entered a concentrated period of new capacity release, and the supply pressure in the PP market gradually increased in November and December. In terms of demand, considering that the current actual demand is still weaker than expected and the new orders of downstream factories have not improved, it is expected that there will be limited room for improvement in the later operating load rate. In addition, at the end of the year, downstream and terminal factories are mainly recovering funds, and demand in some areas is expected to weaken. It is expected that the supply and demand pressure of the PP market will increase in November and December, and the price may be under pressure. However, the expectation of macro-easing in the later period still exists, which may provide support for prices in stages.

Overall, in the future market, under the game between supply and demand pressure and macro-easing expectations, price fluctuations may be repeated. Considering the fierce competition in various links of the industrial chain and the narrowing of profits, it is expected that the market fluctuation amplitude may remain in a low range.